UFI Global Barometer Indicates Record Growth for the Exhibition Sector in 2024

UFI, the Global Association of the Exhibition Industry, has released the latest 32nd edition of its flagship Global Exhibition Barometer research which takes the pulse of the industry.

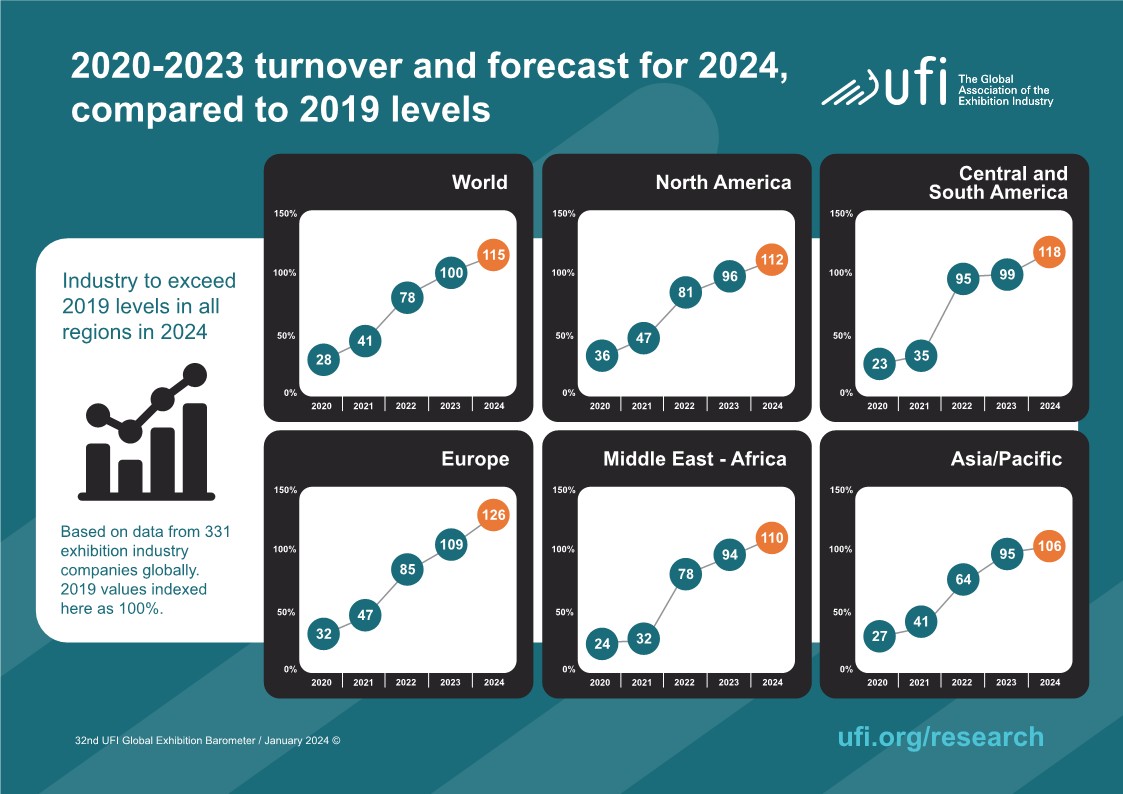

The results highlight that in most markets around the world the exhibition industry fully recovered from the pandemic slump in 2023, with revenues reaching a comparable level to 2019, on average. The outlook for 2024 is very positive, with revenues expected to grow by an average of 15%, setting the industry up to record the highest ever revenue levels in 2024.

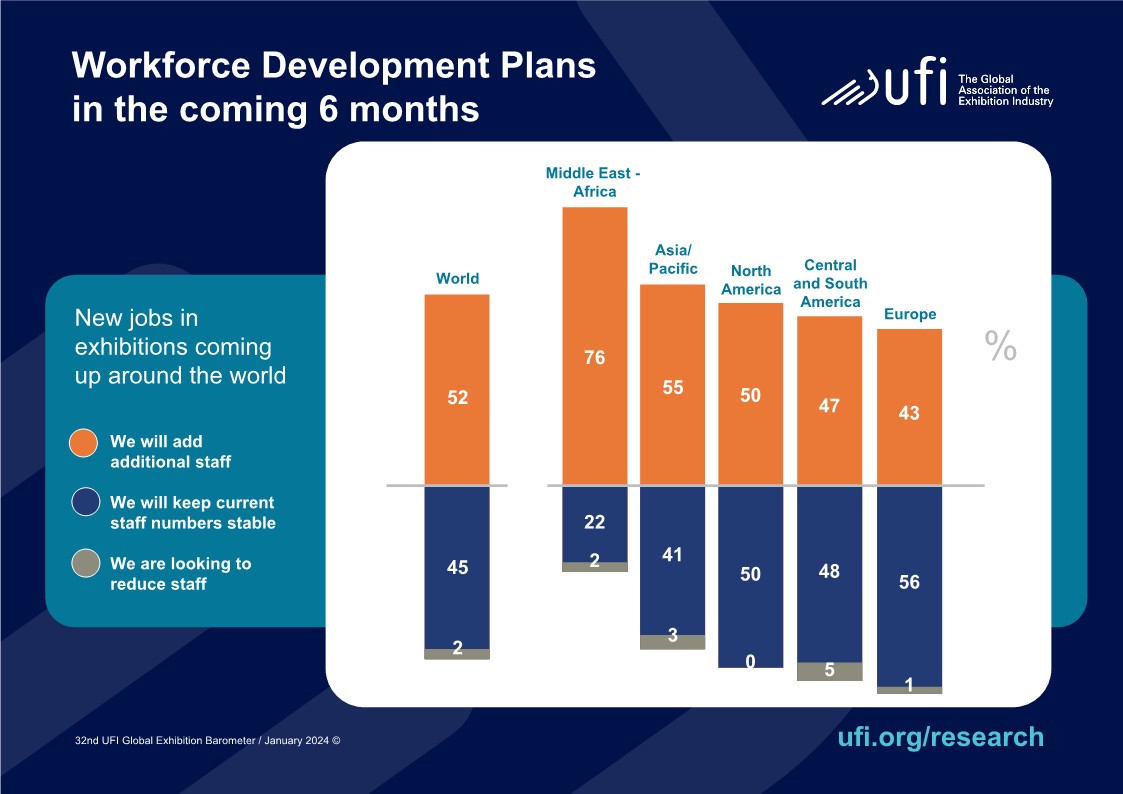

Globally, 52% of companies declare that they plan to increase their workforce in the coming 6 months, and 45% declare that they will keep current staff numbers stable.

“State of the economy in home market” is the most pressing issue (22% of answers globally), followed by “Global economic developments” (17% of answers).

Globally, there is an overwhelming consensus that AI will affect the industry, with 91% of companies stating this, up from 87% in the previous edition. “Our report shows that the exhibition industry hasn’t just reached pre-pandemic levels in 2023 but is also planning to grow in 2024 and many new jobs in exhibitions are coming up around the world. This good news comes in parallel with shifts of business priorities, where economic and environmental considerations show significant progression” says Kai Hattendorf, Managing Director and CEO at UFI.

Size and scope

This latest edition of UFI’s bi-annual industry survey was concluded in January 2024, and includes data from 419 companies in 61 countries and regions.

The study also includes outlooks and analysis for 19 focus countries and regions – Argentina, Australia, Brazil, China, Colombia, France, Germany, Greece, India, Italy, Malaysia, Mexico, Saudi Arabia, South Africa, Spain, Thailand, the UAE, the UK, and the USA – as well as five additional aggregated regional zones.

Operations

The level of operations has clearly picked up in the second half of 2023, with a large majority of companies from all regions (77% in the Middle East and Africa to 57% in North America) declaring an increase.

This trend will continue in 2024 with, on average, a percentage of companies reporting an increased activity ranging from 66% in North America to 64% in the Middle East and Africa, 55% in Asia/Pacific and 54% in Central and South America and Europe respectively.

Turnover and operating profits

The year 2023 witnessed the full recovery of exhibitions, with revenues reaching a comparable level to 2019, on average. The outlook is very positive, with 2024 revenues expected to grow by an average of 15%.

These general trends vary from one country to another:

- Revenues from 2023 compared to 2019 vary from 127% in India, 120% in Spain, and 110% in Italy, to 88% in Colombia and 85% in South Africa, or to 82% in Germany and 80% in Thailand

- Revenues from 2024 compared to 2019 vary from 154% in India 151% in Greece to 99% in China and 94% in South Africa.

In terms of operating profits compared to 2019 levels, around half of the companies are declaring an increase of more than 10% for 2023, and one in four a stable one. Compared to 2022, six companies out of ten are declaring an increase of more than 10%.

The highest proportion of companies expecting a profit increase of more than 10% when compared to 2019 are in the UAE (91%), Saudi Arabia (80%), India (71%), Brazil (67%), and Mexico (64%).

Workforce development

Globally, 52% of companies declare that they plan to increase their staff numbers in the coming 6 months, and 45% declare that they will keep current staff numbers stable.

The highest proportion of companies planning to add staff are identified in Saudi Arabia (100%), the UAE (82%), India (80%), Greece (73%) and Malaysia (67%).

Most important business issues

This edition highlights significant shifts when compared to the previous edition of the Barometer released six months ago:

- The most pressing business issue declared in this edition is “State of the economy in home market” (22% of answers globally - compared with 14% six months ago - and the main issue in all regions, and most markets).

- Overall, “Global economic developments” come in as the second most important issue globally (17% of answers, compared to 12% six months ago), followed by “Geopolitical challenges” (12%).

- “Internal management challenges” (10%) and “Impact of digitalisation” (6%), which were the top 2 issues six months ago (with 21% and 17% of answers respectively), are now also preceded by “Competition from within the exhibition industry” (11%) and “Sustainability / Climate” (10%).

An analysis by industry segment (organiser, venue only and service provider) shows no differences regarding the three most pressing issues for organisers and service providers, which remain “State of the economy in home market”, “Global economic developments” and “Geopolitical challenges”. For venues, “Geopolitical challenges” are preceded by “Internal management challenges” and “Competition from within the exhibition industry”.

The analysis of the trend around top business issues over the 2016-2024 period identifies several important shifts:

- “Global economic developments” & “State of the economy in the home market” are back as the main issue, with 40% of answers.

- “Impact of COVID-19 pandemic on the business” and “Geopolitical challenges”, that both were not in the initial list of issues in 2016 appear, combined, in second position, with 15% of answers.

- “Sustainability / Climate” combined with “Other stakeholders’ issues” is the fastest growing issue, having tripled from 4% of answers in 2016 to 13% in 2024.

- “Competition from within the exhibition industry” (11% in 2024) has gone up slightly again since 2021 but remains less than half of what it represented in 2016 (24%).

- “Internal management challenges” now stands next, with 10% of answers, half of what it represented in the last 2 years.

- “Impact of digitalisation” & “Competition with other media” combined has dropped from 30% or more in the last 2 years to 10% in 2024.

Generative AI applications

For a second time, the 32nd Barometer survey asked a specific question on the impact of generative AI on the exhibition industry, to shed light on this emerging digital transformation. The survey aimed to assess the current utilisation of AI across various business functions and gauge future expectations.

As mentioned above, 91% of respondents consider that AI will affect the industry, up from 87% in the previous edition.

The areas expected to be most affected by the development of AI are: “Sales, Marketing and Customer relations” and “Research & Development” (both 80%) and “Event production” (65%).

These are precisely the areas where generative AI applications are mostly used already (37%, 35%, and 20% respectively).

Background

The 32nd Global Barometer survey, concluded in January 2024, provides insights from 419 companies, across 61 countries and regions. It was conducted in collaboration with 31 UFI member associations: AAXO (The Association of African Exhibition Organizers) and EXSA (Exhibition and Events Association of Southern Africa) in South Africa, ABEOC (Associao Brasileira de Empresas de Eventos) and UBRAFE (União Brasileira dos Promotores Feiras) in Brazil, AEFI (Italian Exhibition & Trade Fair Association) in Italy, AEO (Association of Event Organisers) in the UK, AFE (Spanish Trade Fairs Association) in Spain, AFECA (Asian Federation of Exhibition & Convention Associations) in Asia, AFEP (Asociacion de Ferias del Peru) in Peru, AFIDA (Asociación Internacional de Ferias de América) in Central & South America, AIFEC (Asociacion Colombiana de la Industria de Ferias, Congresos, Convenciones y Actividades Afines) in Colombia, AKEI (The Association of Korean Exhibition Industry) in South Korea, AMEREF (Asociacion Mexicana de Recintos Feriales) and AMPROFEC (Asociación Mexicana de Profesionales de Ferias y Exposiciones y Convenciones) in Mexico, AOCA (Asociación Argentina de Organizadores y Proveedores de Exposiciones, Congresos, Eventos y de Burós de Convenciones) in Argentina, APPCE (Asociación Panameña de Profesionales en Congresos, Exposiciones y Afines) in Panama, AUDOCA (Asociación Uruguaya de Organizadores de Congresos y Afines) in Uruguay, EEAA (The Exhibition and Event Association of Australasia) in Australasia, HKECIA (Hong Kong Exhibition and Convention Industry Association) in Hong Kong, IECA/ASPERAPI (Indonesia Exhibition Companies Association) in Indonesia, IEIA (Indian Exhibition Industry Association) in India, JEXA (Japan Exhibition Association) in Japan, MFTA (Macau Fair & Trade Association) in Macau, MACEOS (Malaysian Association of Convention and Exhibition Organisers and Suppliers) in Malaysia, MECA (Myanmar Exhibition and Conference Association) in Myanmar, SCEGA (Saudi Conventions & Exhibitions General Authority) in Saudi Arabia, SECB (Singapore Exhibition & Convention Bureau) in Singapore, SISO (Society of Independent Show Organizers) for the US, SOKEE (Greek Exhibition Industry Association) in Greece, TEA (Thai Exhibition Association) in Thailand, and UNIMEV (French Meeting Industry Council) in France.

In line with UFI’s objective to provide vital data and best practices to the entire exhibition industry, the full results can be downloaded here

The next UFI Global Exhibition Barometer survey will be conducted in June 2024.

Other Articles

About Us

Supported by the Union of International Associations (UIA), the International Association of Professional Congress Organisers (IAPCO) and the Interel Group, the global public affairs and association management consultancy, Headquarters Magazines serve the needs of international associations organising worldwide congresses.